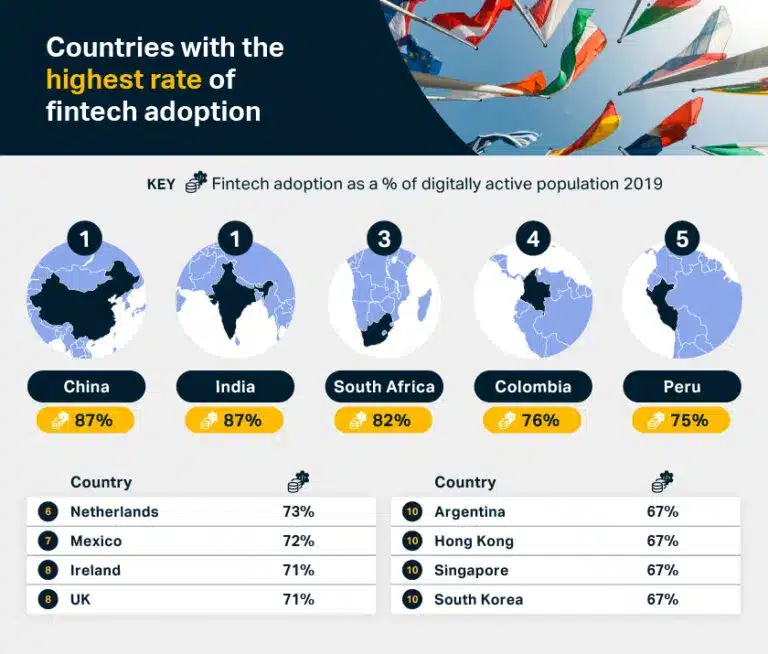

Countries with the highest rate of fintech adoption

Fintech Adoption Hotspots The banking crisis of 2008 created opportunities for innovation in the banking world. This is where financial technology, better known as fintech, saw its rise to prominence. After the 2008 banking crisis, fintech saw its financial investment levels increase twelvefold by 2014, offering a more personalized service that puts people back in control of their finances. Put in simple terms, Fintech refers to new technology that enhances and automates financial services for consumers and businesses. Some examples are Monzo, Venmo and Cashapp, which offer mobile banking and peer-to-peer payment services. This technology can be used to make automated payments and give you instant digital access to your finances. Our financial technology experts at Tipalti have researched which countries have embraced fintech the most. We’ve looked at global fintech adoption rates, Google searches for fintech by country, and the regions that have the highest virtual capital funding, to uncover the world’s biggest Fintech adoption hotspots.

Source: tipalti.com